"Bankruptcy is about financial death and financial rebirth. Bankruptcy is the great American story rewritten. We're a nation of debtors."

Elizabeth Warren

(US Senator, Bankruptcy Law Professor)

Experienced attorneys from Heston & Heston are here to help you file bankruptcy through Chapter 7 in Riverside & Orange County, CA to get a fresh start.

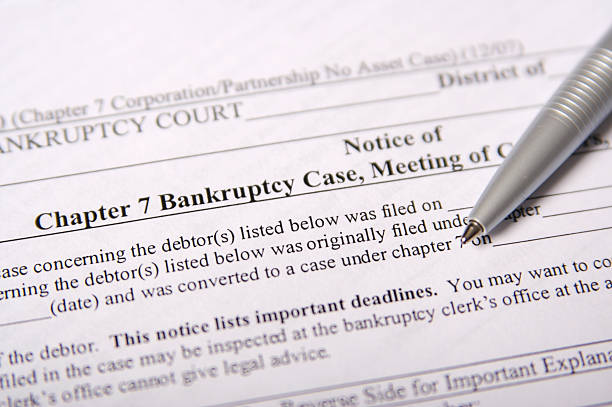

Chapter 7 bankruptcy is the most common chapter to file under as it usually results in the discharge of most or all debts with cases lasting between 4 to 6 months while retaining all of your property through the use of exemptions.

Chapter 7 bankruptcy is also sometime referred to as “liquidation bankruptcy” since, unlike Chapter 13, it does come with the risk of losing property. Through careful and creative use of exemptions and pre-bankruptcy planning, this risk can be mitigated.

The primary considerations in a Chapter 7 are: income, assets, the nature of your debts, and whether you have previously received a discharge. If your income is low enough, you would not loose any assets, and a Chapter 7 will solve your debt problems, then Chapter 7 is probably your best option.

The laws of bankruptcy are not just the Bankruptcy Code, but also involve other Federal laws, State law, and considerations of the law in other jurisdictions. There are many lesser-known aspects of bankruptcy that should be considered in every case, no matter how simple or complex your situation might seem. Heston & Heston Bankruptcy Attorneys have offices in Irvine, Orange County and Riverside, CA. Contact us today and be one step closer to an efficient and successful bankruptcy.

At your initial consultation, we will discuss the specifics of your financial situation. If bankruptcy is your best option, we will clearly explain your options and the process. We will also quote you a fee for our services and make sure that it is something affordable within your budget.

Once we have most of the information we need, we will begin the process of preparing your petition. A bankruptcy petition is around 50-70 pages of required disclosures of your debts, assets, and other details of your current and historical financial situation.

Sometime it makes sense to plan ahead to file sometime in the near future. This could be to avoid the loss of property, maximize exemptions, or to pass the Means Test. If you are in this situation, we will assist you along the way to ensure that the proper steps are taken.

Once your petition is completed and you are in a position to maximize the success of your bankruptcy case, we will file the petition with the court. We will immediately receive judge and trustee assignments and hearing dates.

Once your case is filed, all of your creditors are stayed from taking any actions against you including wage garnishments, bank levies, and furthering court proceedings.

Shortly after filing your case, the trustee assigned to your case will be requesting certain documents and information. Common requests include tax returns, bank statements, mortgage statements. We will make sure that everything is timely provided to the trustee. We will also know which documents the trustee has not requested but would be helpful to your case, and we will provide those as well.

At your Meeting of Creditors, also called the 341(a) Hearing, you will be meeting with the trustee who will be asking you a few questions about your financial situation. We will be with you at this hearing and will be able to assist with legal and procedural issues. This hearing usually goes by fairly quickly and easily.

Creditors have until 60 days after your Meeting of Creditors to file a complaint asking that a debt be determined to be non-dischargeable or that your discharge be denied entirely. The grounds upon which these can be based are very narrow. These cases are very rare and we will usually know if that is something to be concerned about.

Once that 60-day deadline passes, you are entitled to receive your discharge. Usually discharges are entered within a week of that deadline. If there are no other pending issues, your case will usually close within a few days of receiving the discharge.

The Means Test is a pre-requesite to filing a Chapter 7 bankruptcy which is based on your household income. For some, this is a relatively simple test to pass. For others, it can get very complex.

The Means Test is also used in Chapter 13 bankruptcy as a factor in determining your plan payment amount.

If you have already been sued, your creditors might have already attached judgments against your property. A Chapter 7 bankruptcy can remove those liens from your property and discharge the debt.

Once you’ve retained our office, we can stop the creditor harassment even before your case is filed. Once your case is pending or after discharge, creditors can face severe penalties for instituting any type of collection activity, including phone calls, past due notices, filing lawsuits, bank account levies, and wage garnishments.

Contrary to what many people believe, it is actually possible to discharge many tax debts. The general rule is that if a tax debt was due more than 3 years ago, then it might be possible to discharge that debt. However, other factors can complicate this and potentially require strategically approaching your case in order to maximizing your discharge.

Chapter 7, also sometimes referred to as “liquidation bankruptcy”, can come with a risk that some of your property could be taken by the trustee and used to pay off a portion of your debts. By maximizing exemptions, pre-bankruptcy planning, and an expertly drafted petition, this risk can be greatly reduced.

Bankruptcy often involves family law issues including divorce, divorce debts, child or spousal support, and California community property law. These issues require a wealth of knowledge of how bankruptcy and family law overlap.

In a Chapter 7 bankruptcy, you have the option keep or surrender a vehicle. For a financed vehicle, your options are reaffirmation, ride-through, surrender, or redemption. For a vehicle that is leased, you can assume or reject the lease.

While it is true that most student loans are non-dischargeable, some can actually be discharged. There are two situations where this is possible: 1) when repaying the loan would cause an “undue hardship”, or 2) if the student loan does not qualify as a non-dischargeable student loan. Regardless of whether your loans are dischargeable, our attorneys can assist you with understanding what your student loan options are.

Either a Chapter 7 or 13 bankruptcy will stop a foreclosure once the case is filed which imposes a stay against your creditors. In a Chapter 7, this might only be temporary, but it can allow you some breathing room to allow you to pursue your options. In a Chapter 13, you can catch up on your mortgage through monthly payments over a period of up to 5 years.

An adversary proceeding is a separate lawsuit filed in conjunction with a bankruptcy case. There are many types of adversary proceedings that can be filed by creditors, the trustee, the US Trustee, or the debtor.

The most common type of adversary proceeding is one for a determination of non-dischargeability of a debt. There only limited grounds upon which a debt can be non-discharged, the most common are fraud, marital/divorce/support debts, and willful

If the trustee wants to have property forcibly turned over to them, they might be required to file an action asking the court to issue such an order.

Unlike an action regarding dischargeability where a creditor is seeking to have a single debt excepted from discharge, an objection to discharge could result in your entire discharge being denied or revoked.

A fraudulent transfer is where property is transferred prior to a bankruptcy being filed in a manner suggesting that it may have been done to keep property out of the hands of creditors or the bankruptcy trustee. The look-back period is either 2 or 4 years, depending on the circumstances of the transfer and your financial situation at the time of the transfer.

A preferential transfer or payment is where a creditor is paid prior to a bankruptcy case being filed. Depending on the amount and nature of the debt, the trustee may be able to recover that payment or property from the creditor.

Appeals are when a party seeks to have a higher court make a determination of whether the bankruptcy judge’s decision in a case was proper. These cases can make their way up to the district court, bankruptcy appellate panel, circuit court, or United States Supreme Court.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus nec est ut justo sagittis vulputate. Cras fermentum mi diam. Donec tincidunt feugiat mi, at fermentum ex tempor sit amet. Aliquam eu tortor iaculis, scelerisque ex vel, commodo lacus. Integer cursus metus eget sapien molestie viverra. Duis tempor est est, id tincidunt lectus vestibulum sit amet. Nulla consectetur a nisl volutpat euismod. Donec elementum non elit pretium ullamcorper. Nunc aliquet, augue in tempor luctus, arcu urna ultrices lacus, sit amet sagittis ipsum arcu ac ipsum.... Read more

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Phasellus nec est ut justo sagittis vulputate. Cras fermentum mi diam. Donec tincidunt feugiat mi, at fermentum ex tempor sit amet. Aliquam eu tortor iaculis, scelerisque ex vel, commodo lacus. Integer cursus metus eget sapien molestie viverra. Duis tempor est est, id tincidunt lectus vestibulum sit amet. Nulla consectetur a nisl volutpat euismod. Donec elementum non elit pretium ullamcorper. Nunc aliquet, augue in tempor luctus, arcu urna ultrices lacus, sit amet sagittis ipsum arcu ac ipsum.... Read more

Elizabeth Warren

(US Senator, Bankruptcy Law Professor)